Next month, the loan balance would be $ less, thus you can repeat the fresh new calculation with a primary level of $149,. Now, the appeal commission could well be $, plus prominent percentage could be $.

Merely repeat this an alternate 358 minutes, and you might provides yourself an amortization desk having a 30-seasons mortgage. So now you know why having fun with a good calculator is really convenient. But it’s nice to understand how math about the new calculator really works.

You may make a keen amortization schedule to have a variable-speed home loan (ARM), nevertheless involves guesswork. If you have a good 5/1 Sleeve, the fresh new amortization schedule on first 5 years is simple so you can determine since rate is fixed to your earliest 5 years. After that, the pace will to improve shortly after a year. The loan terms and conditions state just how much your own price increases for each 12 months plus the higher that your rates may go, and the low rates.

Sometimes some one need certainly to lower its money faster to keep money on focus and can even want to create an extra percentage or increase the amount of on the regular payment per month become place towards the the main when they can afford it.

Such as for example, for folks who wished to incorporate $50 every single monthly payment, you could use this new formula more than to calculate a special amortization plan and watch how much fundamentally you might pay off your mortgage and exactly how way less interest you might owe.

Contained in this analogy, getting an additional $fifty a month towards their home loan would help the payment per month to help you $. Your interest commission inside the month one would be $, but your prominent payment might be $. The week a couple loan harmony do next feel $149,, and your next month’s interest commission could well be $. You are going to already have protected fourteen dollars inside notice! Zero, that is not very exciting-but what is fun is when you kept it up until your loan is actually paid off, the complete interest create total $80, unlike $ninety-five,. You might additionally be obligations-100 % free nearly step three? decades at some point.

Financial Amortization Isn’t the Simply Form

We have spoke a great deal about financial amortization so far, as that’s what some body constantly contemplate when they hear this new term amortization. But a mortgage is not the merely type of financing you to normally amortize. Automotive loans, family collateral finance, student loans, and personal funds as well as amortize. They have repaired monthly obligations and you will a fixed payoff date.

And that variety of loans dont amortize? Whenever you reborrow money once you pay it back and you will don’t have to spend your debts entirely by a certain go out, then you have a low-amortizing mortgage. Credit cards and you may personal lines of credit was types of non-amortizing finance.

Just how can Playing with an enthusiastic Amortization Calculator Assist me?

- Observe how much dominant you’ll owe any kind of time upcoming time using your loan name.

- Observe how much appeal you have paid back in your mortgage to date.

- Find out how much focus you’ll be able to shell out for individuals who hold the mortgage before avoid of the name.

- Work out how far proceed the link now equity you should have, if you find yourself 2nd-guessing your own monthly mortgage declaration.

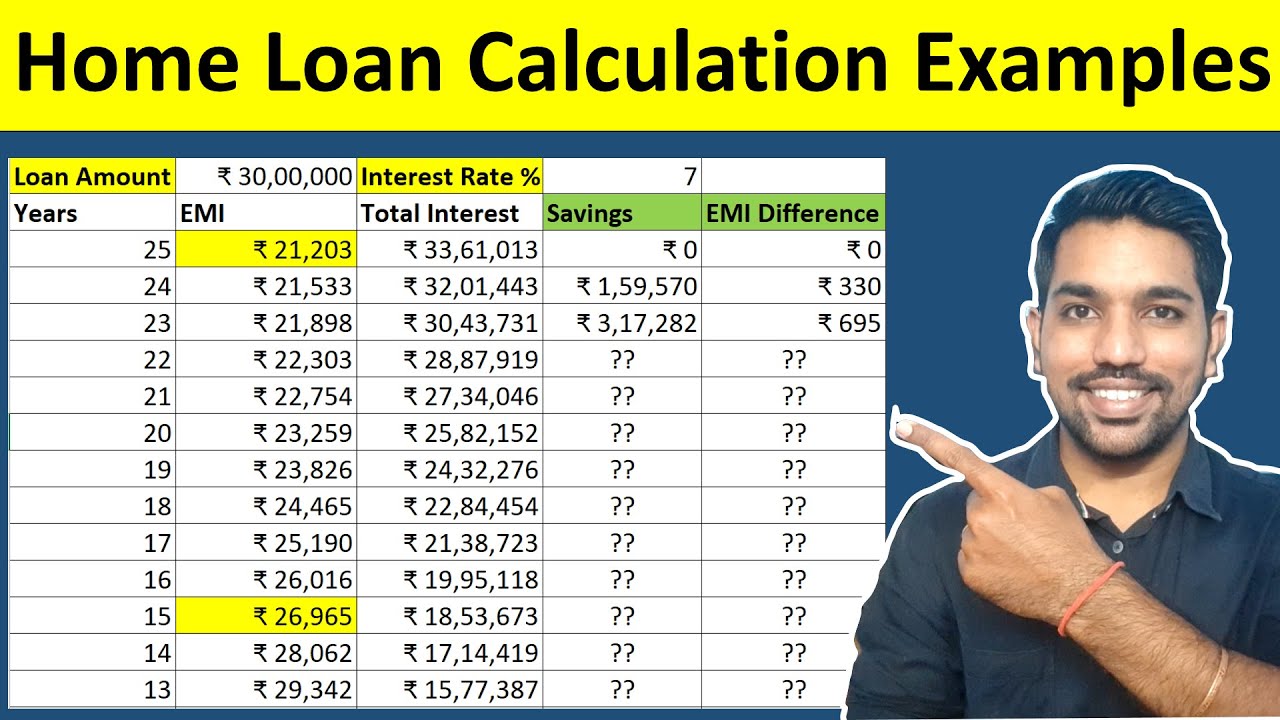

- Observe far attract you are able to pay across the entire name off a loan, in addition to the impact away from choosing an extended or quicker loan label otherwise bringing a higher or lower rate of interest.

So what does Totally Amortizing Indicate?

A fully amortizing loan is one where the regular fee amount remains fixed (if it is repaired-interest), but with different degrees of each other appeal and principal getting paid off out of each time. This means that both the attract and you may dominating for the loan was fully repaid if this grows up. Conventional fixed-rate mortgage loans is samples of fully amortizing funds.

Category: Uncategorized