There are a number of benefits and drawbacks associated with delivering a loan out of your 401K package. You’ll find however times when bringing a good 401(k) loan makes sense but there are even number of situations where it should be prevented. Before taking a loan from the 401(k), you will know:

Men and women are tend to surprised when i state taking an excellent 401(k) mortgage will be the right circulate. People think a monetary planner create suggest Never ever contact your old-age makes up people reasons. Although not, it utilizes what you’re with the 401(k) financing to own. There are a number of circumstances that i enjoys encountered which have 401(k) package members in which taking financing made feel for instance the following:

I could get into more detail regarding every one of these scenarios but let us do a quick run through away from exactly how 401(k) funds works.

How do 401(k) Fund Work?

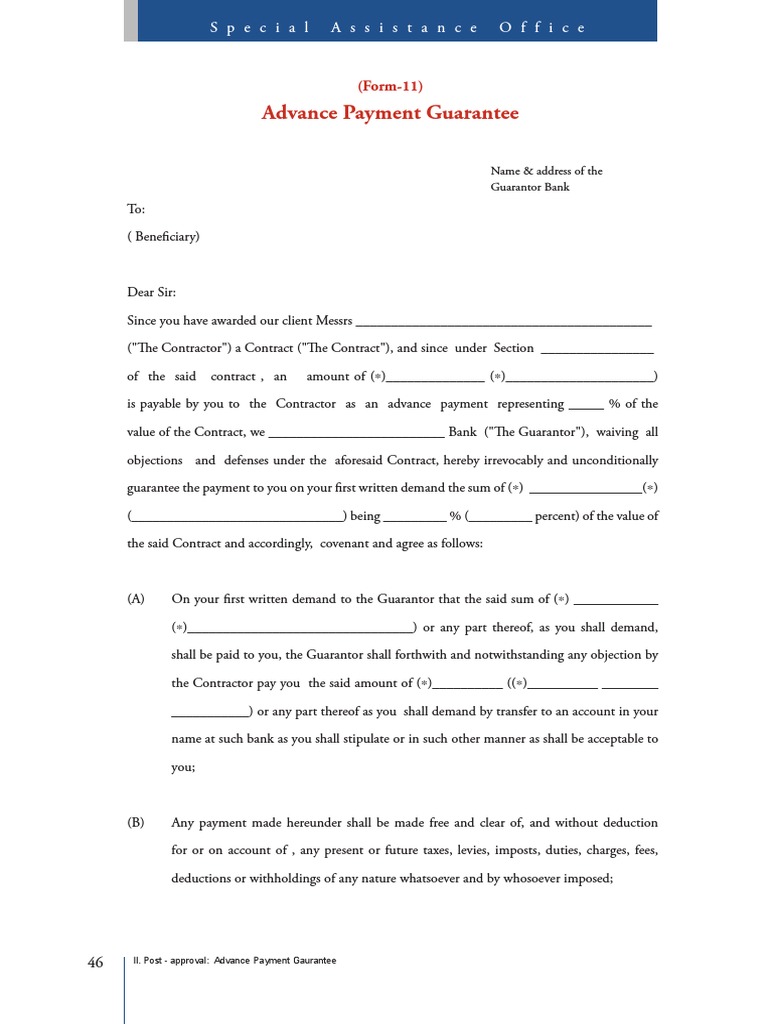

Earliest, not all the 401(k) agreements allow it to be money. Your boss must volunteer allow it to be plan users when planning on taking money up against their 401(k) harmony. The same as other money, 401(k) fund charges focus and have an organized percentage agenda but truth be told there are a handful of differences. Is a simple breakout of how 401(k) loans performs:

How much Might you Acquire?

Maximum 401(k) loan amount that one may take is the Smaller of 50% of vested equilibrium otherwise $fifty,000. Simple example, you really have a beneficial $20,000 vested harmony regarding the package, you could potentially get a 401(K) financing around $10,000. The newest $fifty,000 limit is for package users that have balances over $100,000 on plan. When you have a 401(k) equilibrium from $five hundred,000, you are nonetheless simply for a $50,000 loan.

Yes, 401(k) money fees attract However you spend the money for interest back to your own individual 401(k) membership, so officially its an appeal free mortgage however, there was focus built-into the amortization plan. The rate energized by the very 401(k) systems is the Finest Price + 1%.

How much time Do you have to Pay-off The new 401(k) Mortgage?

For some 401(k) money, you are free to find the financing period anywhere between step 1 and you can 5 many years. By using the loan order your first house, the loan coverage could possibly get will let you offer the borrowed funds course to fit the length of their home loan however, be cautious that have this package. For those who log off the brand new workplace before you could rewards the loan, it could bring about unexpected fees and penalties and this we’ll cover afterwards.

How can you Repay The fresh new 401(k) Loan?

Mortgage costs was deducted from the salary according to the mortgage amortization agenda and they’re going to remain through to the mortgage is actually paid in complete. If you are self-employed rather than payroll, you will have to publish costs on 401(k) system to eliminate that loan default.

And additionally, most 401(K) platforms supply you with the option of settling the borrowed funds very early through an individual examine otherwise ACH.

Perhaps not A nonexempt Experience

Getting a great 401(k) financing will not bring about a taxable event such an excellent 401(k) delivery do. This provides 401(k)’s a tax advantage over a keen IRA since IRA’s dont succeed funds.

Scenarios Where Bringing Good 401(k) Finance Is practical

I am going to start towards self-confident region of the money of the that delivers specific real-world scenarios where bringing an effective 401(k) mortgage is practical, however, remember that all the these situations believe that your do not have sluggish cash booked that will be utilized to meet this type of costs. Providing an excellent 401(k) mortgage often scarcely make an impression https://paydayloancolorado.net/ward/ on playing with lazy cash as you remove some great benefits of compounded income tax deferred attention when you get rid of the money from your account in the form of a good 401(k) mortgage.

Category: Uncategorized