Discover 7 capital choices for their North park family remodeling opportunity. From cash to help you structure finance, find a very good fit for your budget and needs.

Murray Lampert has been creating, building work, and you may strengthening property for the Hillcrest because the 1975. At that moment, we have seen of several alterations in do it yourself financing. Thankfully, now discover higher loan applications to have customers trying to create new belongings or boost their most recent characteristics.

Before you could score past an acceptable limit later towards excitement off making your house renovate, individualized cooking area, or perhaps in-legislation collection, it is very important provides a realistic thought of just what a typical domestic restoration opportunity will set you back.

I encourage establishing a funds, including discussing just how you are going to shell out for your home restorations investment. Having favorable interest levels and advanced level financing software, even if you has actually cash on hand, you are best off waiting on hold so you’re able to they.

Lower than we’ve got detail by detail some of the most popular options one to property owners think prior to it start a property renovation. It’s up to you to be aware of the novel economic problem and you can carry out what is actually best for you plus friends. Which have any highest investment, you should know the effects and select the latest direction that meets your top.

Solution 1: Cash

Expenses money is always your best option with regards to to financial support a property update opportunity (as opposed to taking right out a credit line). Although not, it is not sensible to imagine most home owners have the money for a major restorations venture available. Sometimes, the common build otherwise remodeling endeavor for the North park Condition was not in the thousands of dollars, in the brand new millions.

Even though you you will pay-all bucks, it’s probably not an informed use of your discounts if you do not are performing an extremely brief up-date or update. To possess large household building work plans, we recommend playing with dollars so you’re able to offset exactly how much you will need to acquire. This is actually the easiest solution, however, there are plenty much more.

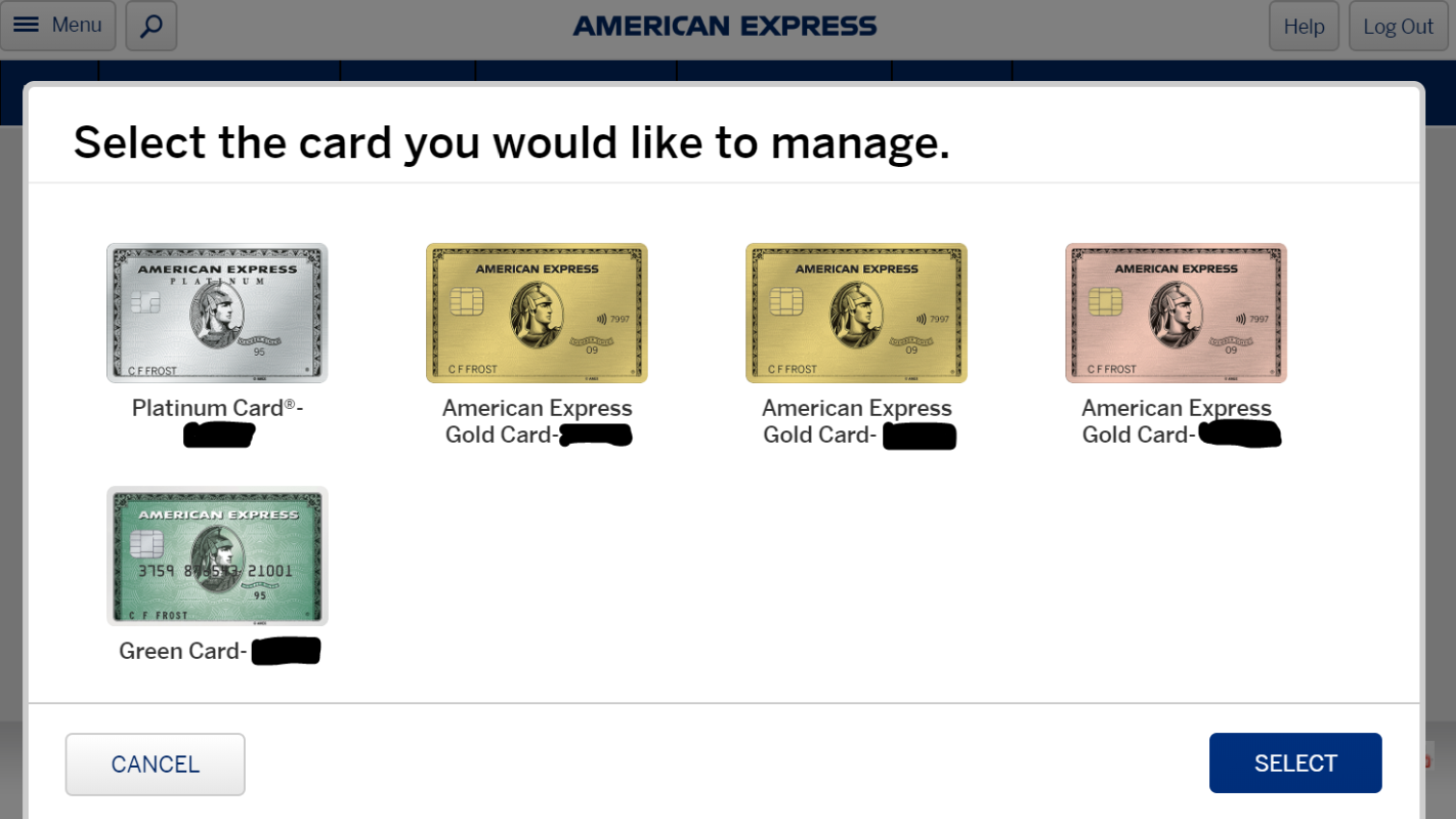

Option dos: Low-Interest Playing cards

If you are a resident, you have probably come mocked having some mastercard products more than your mature life. When you’re credit is healthy, nothing is wrong with placing small in order to medium sized house recovery projects into the a no finest attract or low interest rates borrowing from the bank cards.

It trick here’s to help you without a doubt shell out which content of easily, so we try not to strongly recommend getting an excellent $20,000 venture on a visa. Genuinely question, am i going to be able to shell out it from up until the credit card provide ends and i also beginning to accrue notice? If you are unclear in any way, don’t do it.

But when you understand you have got higher credit, and certainly will repay the balance on the right amount out of day, this might be a practical choice for your.

Option step 3: Cash-Out Re-finance

Based on how long you’ve been of your property, a favorable choice will be dollars-aside refinancing. A profit-away refinance is an excellent complement major home repairs, ree you could combine high-focus personal debt. This program involves refinancing your home and you can taking out fully security and you can as well as based on future really worth once developments.

There are many bank options for dollars-aside refinancing. Start by your existing mortgage holder, individual bank relationships or borrowing unionpare those individuals to other lenders otherwise focus on a design-create organization that a relationship which have a neighborhood financial.

Something you should keep in mind about this is the pricing recoup of variety of repair enterprise. As you will be utilizing your family while the security up against a more impressive financing, you need to build developments that improve your home’s worthy of. Perform a little research and get the renovations specialist in regards to the expected rates recoup of numerous household remodeling systems before getting already been.

تصنيف: Uncategorized